Welcome to my article on understanding federal tax credits for solar energy installation. In today’s world, where the need for renewable energy sources is becoming more crucial, solar panels are gaining popularity as a sustainable and cost-effective solution. The good news is that the United States government offers federal tax credits to incentivize individuals and businesses to adopt solar panel installation, reducing energy costs and promoting sustainability.

Solar energy is not only environmentally friendly but also a long-term investment that can save you money on your energy bills. However, the upfront costs of installing solar panels can be a barrier for many. That’s where federal tax credits come into play, making solar energy more accessible and affordable for homeowners and companies alike.

By taking advantage of these tax credits, you can not only reduce your energy costs but also contribute to a greener future. Let’s dive deeper into the eligibility criteria, benefits, and the process of claiming these federal tax credits for solar panel installation.

Key Takeaways:

- Federal tax credits incentivize the adoption of solar panel installation.

- These credits help reduce the upfront cost of solar panels.

- Installing solar panels can lower energy bills and promote sustainability.

- Residential and commercial properties must meet specific criteria to be eligible.

- Completing the necessary IRS forms is key to claiming these tax credits.

Eligibility for Federal Tax Credits

To be eligible for federal tax credits for solar panel installation, both residential and commercial properties must meet certain criteria.

For residential properties, the solar panels must be installed on the taxpayer’s primary or secondary residence and must meet the requirements of the Residential Energy Efficiency Property Credit.

The Residential Energy Efficiency Property Credit allows eligible taxpayers to claim a credit for the cost of qualified solar electric property and qualified solar water heating property installed on their homes.

Commercial properties, on the other hand, must meet the requirements of the Business Energy Investment Tax Credit. These criteria include factors such as the type of solar energy system installed, the capacity of the system, and the use of the property.

Benefits of Federal Tax Credits for Solar Energy Installation

There are several benefits to taking advantage of federal tax credits for solar panel installation. Firstly, these credits can provide significant financial savings by reducing the upfront cost of installing solar panels. The savings can be in the form of a dollar-for-dollar reduction in taxes owed or as a refund if the taxpayer does not have sufficient tax liability.

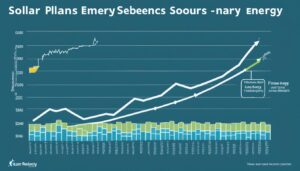

Additionally, solar energy systems can lower energy bills by generating electricity and reducing reliance on traditional energy sources. With solar power, homeowners and businesses can rely on their own generated electricity, which helps to offset the cost of power from the grid. This translates into significant financial savings over time, as well as protection against rising electricity rates.

Furthermore, the environmental impact of solar panel installation is substantial. By transitioning to solar energy, individuals and businesses can reduce their carbon footprint and contribute to a cleaner and more sustainable environment. Solar power is a renewable energy source that does not produce harmful greenhouse gas emissions, making it a key player in combating climate change.

“Solar power is a game-changer. Not only does it provide financial savings for individuals and businesses, but it also benefits the planet by reducing our reliance on fossil fuels and decreasing carbon emissions.”

– Sarah Johnson, Environmental Activist

Taking advantage of federal tax credits for solar panel installation not only offers financial savings but also aligns with the global effort to combat climate change and promote sustainable practices. By going solar, individuals and businesses can take an active role in creating a greener and more energy-efficient future.

How to Claim Federal Tax Credits for Solar Energy Installation

To claim federal tax credits for solar panel installation, taxpayers must complete the appropriate IRS Form along with their annual tax return. For residential properties, the credit can be claimed using Form 5695 – Residential Energy Credits. Commercial properties, on the other hand, can claim the Business Energy Investment Tax Credit using Form 3468 – Investment Credit.

“By leveraging federal tax credits, individuals and businesses can significantly reduce their upfront costs for solar panel installation, making renewable energy more accessible and affordable.”

It is crucial to carefully follow the instructions provided by the IRS to ensure accurate completion of the forms. Taxpayers should review the eligibility requirements and gather all necessary documentation before starting the filing process. Failure to adhere to the instructions or include essential documents may result in delays or issues with claiming the credits.

IRS Forms for Claiming Federal Tax Credits:

| Property Type | IRS Form |

|---|---|

| Residential | Form 5695 – Residential Energy Credits |

| Commercial | Form 3468 – Investment Credit |

By completing these IRS forms accurately and including the required documentation, taxpayers can claim their federal tax credits for solar panel installation. It is important to consult professional tax advisors or utilize online resources provided by the IRS for detailed instructions and guidance.

Understanding the process of claiming federal tax credits for solar energy installation is essential for individuals and businesses looking to take advantage of financial incentives while transitioning to renewable energy sources. By following the instructions provided on the appropriate IRS forms, taxpayers can ensure a smooth and successful claim process for their solar panel installation credits.

Conclusion

Federal tax credits for solar panel installation provide valuable financial incentives that not only help reduce energy costs but also promote the adoption of renewable energy for a more sustainable future. By leveraging these credits, homeowners and businesses can not only save money but also contribute to the overall transition to clean energy sources.

Understanding the eligibility criteria, benefits, and process for claiming these tax credits is crucial for individuals and companies. By meeting the necessary requirements and following the guidelines provided by the Internal Revenue Service (IRS), eligible taxpayers can take advantage of the financial benefits these credits offer.

By embracing solar energy through the installation of solar panels, individuals and businesses can lower their carbon footprint and reduce their reliance on traditional energy sources. This transition to renewable energy not only benefits the environment but also contributes to a more sustainable and greener future for all.

With the support of federal incentives such as tax credits, more individuals and businesses are encouraged to invest in solar panel installation, leading to a widespread adoption of renewable energy and a positive impact on both the environment and their financial well-being.

FAQ

What are federal tax credits for solar panel installation?

Federal tax credits for solar panel installation are incentives provided by the United States government to encourage the adoption of renewable energy sources. These credits can significantly reduce the cost of installing solar panels for residential and commercial properties, making it more affordable for individuals and businesses to transition to clean energy.

Who is eligible for federal tax credits for solar panel installation?

Both residential and commercial properties can be eligible for federal tax credits for solar panel installation. Residential properties must have the solar panels installed on the taxpayer’s primary or secondary residence and meet the requirements of the Residential Energy Efficiency Property Credit. Commercial properties must meet the requirements of the Business Energy Investment Tax Credit, which includes factors such as the type of solar energy system installed, the capacity of the system, and the use of the property.

What are the benefits of federal tax credits for solar panel installation?

There are several benefits to taking advantage of federal tax credits for solar panel installation. These credits can provide significant financial savings by reducing the upfront cost of installing solar panels. Solar energy systems can also lower energy bills by generating electricity and reducing reliance on traditional energy sources. Additionally, transitioning to solar energy can help individuals and businesses reduce their carbon footprint and contribute to a cleaner and more sustainable environment.

How can I claim federal tax credits for solar panel installation?

To claim federal tax credits for solar panel installation, taxpayers must complete the appropriate IRS Form along with their annual tax return. Residential properties can use Form 5695 – Residential Energy Credits, while commercial properties can use Form 3468 – Investment Credit. It is important to carefully follow the instructions provided by the IRS and ensure that all necessary documentation is included with the tax return to avoid any delays or issues with claiming the credits.

Source Links

- https://themercury.com/lifestyles/entertainment/chris-rock-directing-remake-of-another-round/article_8644f463-128d-509d-805a-49e99057e87f.html

- https://www.latitudemedia.com/news/crux-lands-18-million-from-a16z-for-tax-credit-market-buildout

- https://www.pv-tech.org/qualitas-energy-buys-heelstone-with-20gw-us-solar-and-storage-portfolio/